While lagging behind the other domains, the finance sector has made great strides toward aligning with global technological growth. Today, all finance processes, from money transfers to financial enquiries, are accomplished in minutes through well-structured banking applications.

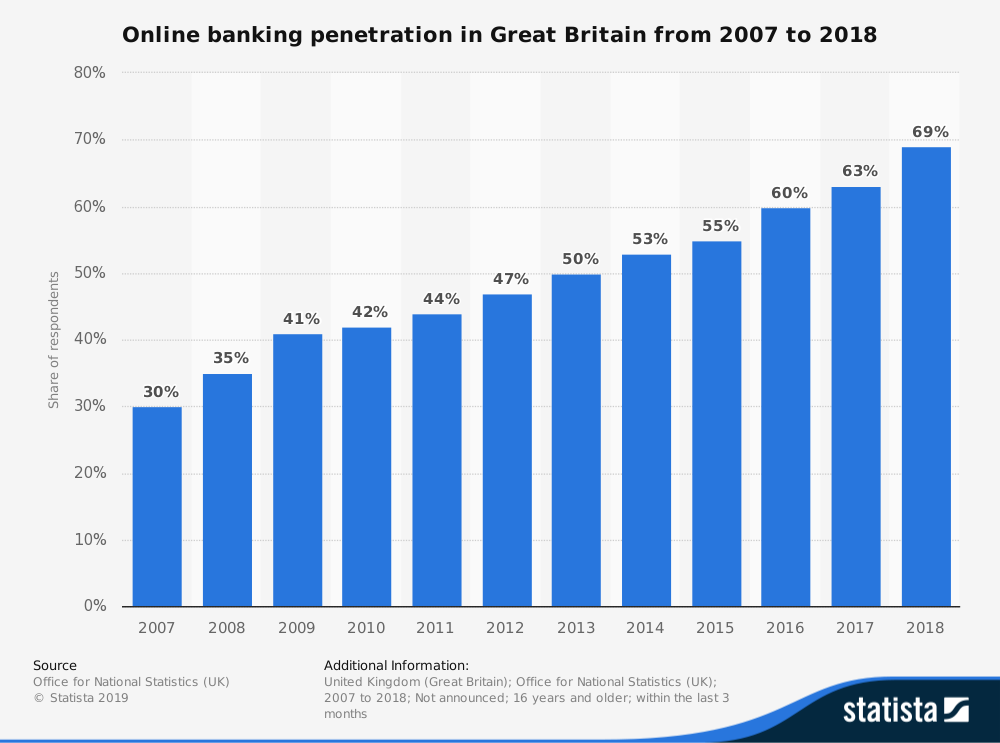

Nearly 70% of the British population relies on mobile banking apps, which have revolutionised financial management. They have eliminated the need to rush to the banks, streamlined account management, and empowered people to stay on top of their finances. These apps, with their swift, reliable, and easy-to-handle features, put the power of financial control in the hands of the users.

However, how much does mobile banking app development cost? What does the mobile banking app development process entail? The process typically involves several stages, including planning, design, development, testing, and deployment. Each stage requires a different set of skills and expertise, which can impact the overall cost of development.

This comprehensive read explores the cost of developing a mobile banking app for customers and financial institutions. It also delves into the banking app development best practices to offer maximum user benefits and technically supercharge the finance sector.

However, it’s important to note that mobile banking app development can be a complex and challenging process, requiring a high level of technical expertise and careful planning. Understanding these challenges can help you navigate the development process more effectively.

Understanding Mobile Banking App Development

If you are seeking online banking app development services in the UK, you must have a thorough understanding of the apps. Let’s learn what a banking application is and what it must entail.

A structured banking app allows steady financial transactions across users. Customers can access their bank accounts, check balances, and manage debit and credit cards. These applications are developed for mobiles and tablets, offering convenience for paying bills and handling finances.

When it comes to banking app development, security is paramount. Developers incorporate numerous security features, from face recognition to two-step authentications, to protect customers’ personal information and financial data. These robust security measures are designed to prevent unauthorised access, providing users with a sense of reassurance.

Additionally, present-day online banking apps have advanced features like investment and budgeting tools. For example, some apps offer personalised spending insights, allowing you to track your expenses and identify areas where you can save.

Others provide investment advice based on your financial goals and risk tolerance. These advancements have empowered financial planning among people, making it easier and more accessible than ever before.

Significance of a Digital Banking App

Banking applications are not created solely for customers to manage their finances. Yes, users can benefit in numerous ways—24/7 bank access, cashback opportunities, easy online transactions, etc.

Simultaneously, these banking applications aid finance institutions and banking businesses. They experience a competitive advantage amidst the digital banking sector and gain a positive user base. For financial institutions, mobile banking apps can reduce operational costs, improve customer service, and increase customer loyalty. For businesses, they can provide valuable customer insights, facilitate targeted marketing, and enhance customer engagement.

Through a well-developed mobile banking app, money management is effortless. You can optimise your spending budget and focus on quality investing. Additionally, paying other bank account holders is seamless and secure with a mobile banking app.

For the banking business, applications can easily track users, their spending habits, financial details, and more. Companies can leverage personal data to offer personalised banking solutions, advanced security and savings.

A well-developed digital banking app is not just a tool for managing finances; it’s a catalyst for sector growth, financial independence, and mass awareness of finances. It has the potential to transform the way we handle money, inspire financial planning, and drive the finance sector forward.

Features and Functionalities of a Mobile Banking Application

As technology and the banking sector evolve, consumers will experience advanced banking solutions without stepping into a bank. They can access their accounts across multiple devices and manage their earnings and savings effortlessly. Businesses can experience complete control over consumer data and deliver personalised services.

Here are all the prominent features and functionalities of a mobile banking application –

1. Account Management

The primary purpose of a mobile banking application is easy access to account information. Users can monitor more than one account and multiple cards, view spending history, transfer funds, and more. Additionally, advanced banking applications offer investment portfolio management, intelligent savings, and advanced mandate features.

2. Secure Login

Secure login functionality is a must for all small to large-scale banking businesses. However, the security features must be robust – yet offer a positive banking experience. For instance, a two-factor login can be troublesome during quick tasks. However, a biometric fingerprint login benefits users highly and contributes to the application’s credibility rate.

3. QR Code Payments

QR code payment options are the most common contact-free payment features most avant-garde mobile banking applications utilise. It is an easy solution for businesses to accept and consumers to pay across domains. You will find these super convenient payment solutions – from supermarkets to local departmental stores.

4. Online Banking

Through digitisation, traditional core banking solutions are available at the fingertips through the applications. Online banking abilities will reduce onboarding and transaction friction and deliver a smooth financial experience for businesses and customers.

5. P2P Payments

P2P or Peer-to-peer payment means transferring money from one account to another using mobile banking app. P2P capabilities settle the transferred amount instantly and securely. Users can avoid transfer verification, especially during emergencies.

6. Bill Payment

Most mobile banking apps now feature a bill payment dashboard that resolves all the issues with traditional bill payment. From missing the last bill day to losing paycheques in the mail, bill payment through a digital banking app helps resolve it all.

A mobile banking app offers a secure and reliable bill payment dashboard for monthly essentials. Additionally, the app can have alert and autopay features to streamline monthly billing.

These are the mandatory features and functionalities of a mobile banking application. However, businesses can choose more advanced features to improve the banking experience. To gain a competitive advantage, we suggest consulting with a banking app development agency in the UK.

Factors to Consider When Planning a Mobile Banking App Design

Now that you have finally decided to launch your mobile banking app, it is time to focus on the essential factor. Whichever type of digital banking app you launch must cater to your target audience. Therefore, simple factors such as the visual presence and usability of the banking app determine its success.

Here are a few factors to consider for the mobile banking app design –

- Simplified Interface – with a de-cluttered presence that makes banking the easiest thing ever. The banking app must have a sleek presence with a functional interface. The colour palette must align with the brand and create a sense of trust and reliability.

- Personalised Experience – to foster trust among the audience. It entails offering promotions, suggestions, offers and recommendations. Quality connection with the customers helps banking brands gain a competitive edge.

- Advanced Security — for sensitive information like card details, passwords, addresses, and account numbers. Robust security measures help protect data and mitigate the business’s reputation damage.

- User Experience – The primary goal of a mobile banking app is to make financial tasks easy. Therefore, the app presence must offer smooth functionality, a clutter-free presence, and an intuitive design.

These are simple yet effective aspects of the mobile banking app design. These aspects contribute to a positive banking experience and help the business grow.

Factors that Influence the Mobile Banking App Development Costs

The final cost of the banking app development depends on a few parameters of the development process. For instance, app wireframing is essential to the mobile banking app design process. A complex wireframe will require more project hours and lead to increased development charges.

Let us explore some of the essential factors of the process that influence the mobile banking app development cost –

- Wireframing – It is an essential step in the design and development process and determines the architecture and layout of the banking app. The wireframe can be simple to complex and requires multiple tests before finalisation. Professional banking app developers in London utilise wireframe tools and rely on client feedback during this process.

- UI/UX Design — Wireframe and UI/UX design are correlated. They deliver users a functional mobile banking application that must have all the banking essentials and design factors that create a positive journey. UI/UX design ensures an intuitive banking experience with a distraction-free minimalist layout.

- App Platform—The choice of application platform influences the development charges as well. There are two prominent application platforms: Android and iOS. Several businesses choose to launch on a single platform and move to other platforms after success. The choice of platform may have negligible differences; however, the multiple development phases can be expensive.

- Team Size – Whether you hire a banking app development agency in London or work with individual mobile banking app developers in the UK, the team size difference comes with a cost. An agency has a larger team that brings expertise to the table. The initial cost of hiring can be expensive but reduces the chances of future damage control.

- Location of the agency — Additionally, the location of your banking app development agency is another considerable cost. For instance, hiring mobile banking app developers from the European or US region will cost more than hiring from Asian countries. The cost of developing a banking app increases as you travel from East to West; choose wisely.

- App Maintenance – Similar to every other mobile application, the development process is not done with the creation alone. App maintenance is a prominent part of the development process and must be calculated within the budget. Effective maintenance ensures the application is free from bugs, offers optimum performance and stays competitive.

- Technology Integration — Several exclusive technological advancements occur daily. Incorporating these will help future-proof your mobile banking application. However, integrating technologies like AI and Blockchain comes with additional costs.

Apart from these, banking app development entails rigorous testing to ensure smooth functionality and usability. While the complexities vary, businesses can choose how much they will invest.

Opting to improve the feature set of your mobile banking is signing up for scalability. Additionally, from UI/UX design to app maintenance, none can be skipped, especially if you are planning a successful banking app.

Consult with the professionals to discuss the cost of mobile banking app development and the overall process for planning the budget.

Must-Have Features of a Mobile Banking App

While we have discussed a lot about mobile banking app development costs, let us explore some promising features for the mobile banking app. Remember, the digital sphere, including the banking and finance sector, is highly competitive. Unique features with functional efficiency are a must to cater to the growing needs of users.

These must-have features make your mobile banking app credible and competitive. Additionally, a quality, feature-packed application contributes to a positive user experience and gains traction among users.

- App Access—It is paramount to ensure seamless and secure access to the app. Robust authentication methods like biometric recognition, PINs, or passwords help safeguard user data and prevent unauthorised access. A user-friendly yet robust login process is crucial for instilling trust and confidence in users.

- Account Information—Real-time information on account balances, transaction history, and financial statements financially empowers users. A comprehensive overview of financial status enables informed decision-making and effective financial management.

- Payment and Transfer – Seamless payments and transfers within the app are a cornerstone feature. Integration of various payment methods and support for multiple currencies enhance the app’s versatility, catering to diverse user needs. A streamlined payment process ensures robust security; this is imperative for user convenience and trust.

- Transaction History – A detailed transaction history is indispensable for users to track their finances. Focus on providing a comprehensive record of transactions, including dates, amounts, and types. This feature enables users to monitor spending, identify trends, and manage their accounts effortlessly. Access to historical data fosters transparency and enhances user experience.

- Push Notifications – Real-time push notifications keep users informed and engaged. Alerts about account activities such as deposits, withdrawals, or pending payments enable users to stay updated on their financial transactions without needing to check the app. Personalised and timely notifications are essential for a positive user experience and are banking app best practices.

- Bank and ATM Locations – Not many mobile banking apps offer this feature, making it a competitive and distinctive inclusion. A feature that enables users to locate nearby bank branches and ATMs is crucial for convenience. Integration with mapping services allows users to find the nearest physical banking facilities effortlessly.

- In-App Chat — Users can communicate directly with customer support representatives or banking professionals through in-app chats. For queries about transactions, account information, or general banking inquiries, real-time chat support provides swift assistance. Efficient customer support enhances overall satisfaction.

- ATM Connectivity – Enabling users to perform ATM-related functions directly from the app enhances convenience. Features such as cardless cash withdrawals, ATM pre-staging, or transaction notifications enhance user experience and streamline the ATM process.

- Voice Commands – Voice command capabilities allow users to interact with the banking app hands-free. It enhances accessibility and makes the app convenient, irrespective of usage time and space. Users can perform various tasks such as checking account balances, making payments, or initiating transfers simply by using voice commands, providing a more intuitive and user-friendly experience.

- AI Integration — Incorporating artificial intelligence (AI) technologies enhance the app’s functionality and personalisation capabilities. AI-powered features such as personalised financial insights, predictive analytics for spending patterns, or intelligent chatbots for customer service streamline user interactions. Utilise user behaviour data and preferences to deliver recommendations.

- App Security – Robust app security is paramount, especially when dealing with sensitive data and banking details. It safeguards user data and prevents unauthorised access or fraudulent activities.

Advanced security measures such as end-to-end encryption, multi-factor authentication, biometric recognition, and real-time fraud detection mechanisms boost confidence in users. Additionally, this fosters trust and reliability in terms of security standards.

These are must-have features for a mobile banking app navigating the digital realm in 2024. They deliver a comprehensive and user-centric banking experience that meets evolving needs and user expectations.

Consult a professional banking app development agency to discuss the various features and how they can elevate your business.

Average Banking App Development Costs in 2023

Based on market research and the previous year’s analysis, the average cost of developing a mobile banking app in the UK ranged from £50,000 to £150,000 or more. It was the range in the year 2023.

The overall cost, as discussed, is influenced by multiple factors such as complexity, features incorporated, and development time. The charges encompass various aspects such as design, development, testing, integration, and deployment.

Banking App Development Predictions for 2024

Moving forward in 2024, we predict an increase in average development costs due to the continued evolution of technology. The increased demands for advanced features and heightened focus on security and compliance have increased the complexity.

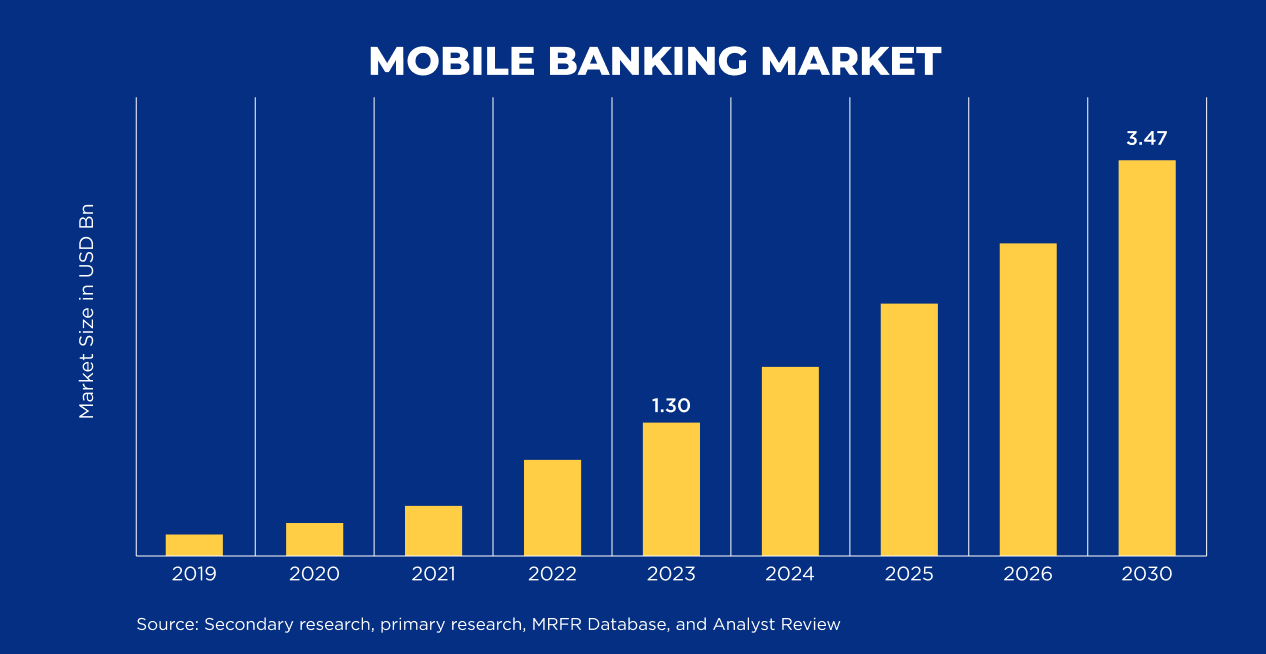

With the steady growth of digital banking applications and user expectations, banks and financial institutions are investing more in mobile app development. Application enhancement, aligning with the trends, is essential to stay competitive and effectively meet customer demands.

However, it’s crucial to consider the quality of development services and adherence to regulatory standards when opting for lower-cost solutions.

Businesses can outsource to Asian countries like India to reduce the cost of mobile banking app design and experience similar skilled development.

Finding the Right Mobile Banking App Development Agency in London

Selecting the right development partner for a mobile banking app development is critical. Finding the perfect partner impacts the success of the project significantly. Let us explore this comprehensive guide to identify and evaluate potential partners.

Factors to Consider When Searching for a Mobile Banking App Development Agency –

1. Expertise and Experience

Look for app development agencies with a proven track record of success in mobile app development. Look closely into their expertise in the banking and finance sector. Evaluate their technological experiences with iOS, Android, and backend development. Analyse their familiarity with industry-specific regulations and security standards.

2. Portfolio and Case Studies

Review the portfolio and case studies to assess the quality and diversity of the projects. Pay attention to banking projects similar in scope and complexity to yours. Inquire about their role in those projects, including design, development, testing, and deployment.

3. Reputation and Client References

Seek feedback from previous clients or industry peers to gauge the agency’s reputation and reliability. Client testimonials, reviews, and referrals can provide valuable insights into the partner’s communication, collaboration, and problem-solving abilities. Do not rely on website reviews alone; check out third-party review websites to analyse the agency.

4. Technical Capabilities and Resources

Ensure the development agency has the necessary technical capabilities, resources, and infrastructure to handle your project efficiently. Consider factors such as team size, expertise in programming languages and frameworks, and access to cutting-edge tools and technologies. Also, gauge their knowledge about app development trends and best practices.

5. Compliance and Security Standards

Verify whether the development agency adheres to industry-specific compliance requirements and security standards. A thorough understanding of regulatory frameworks and commitment to data privacy and security are essential for banking app development.

Tips for Negotiating Pricing and Ensuring Transparency

If you have already finalised the agency for your mobile banking application, here are tips and strategies to ensure transparent discussions about payment and services.

- Clearly define project requirements, objectives, and scope before engaging with potential agencies. It will prevent misunderstandings and ensure both parties align with the expectations.

- Request detailed proposals from multiple development partners, including breakdowns of costs, timelines, deliverables, and milestones. Compare proposals based on pricing and expertise before approaching with requirements.

- Consider options such as fixed-price contracts, time and materials contracts, and milestone-based payments, and clarify payment terms, including upfront costs and payment schedules.

- Prioritise methodical communication throughout the development process. It ensures transparency and accountability. Establish clear channels for communication, regular progress updates, and feedback sessions to address issues and concerns promptly.

- Formalise your agreement with the development agency by signing contracts and service level agreements (SLAs) that outline project timelines, deliverables, responsibilities, and dispute resolution mechanisms. Clarify terms related to intellectual property rights, confidentiality, and termination clauses to mitigate risks.

These guidelines help establish a successful partnership with a mobile app development agency in London. It leads to a high-quality, secure, user-friendly mobile banking app tailored to your requirements and objectives.

Entering the Digital Banking Landscape in 2024

Now that you have understood the overall mobile banking app development cost, it is time to plan towards effective investing. We have also explored the factors influencing the development cost and the must-have features that make a banking app scalable.

This 2024, we suggest banks and financial institutions invest in a quality custom mobile banking app with modern features to stay on the front lines of the market. Focus on robust security measures, optimum usability, and ease of access for a successful app launch.

We have offered the essential strategies for hiring the best professionals to develop an efficient banking application. Analyse their expertise, judge the reviews, and select smartly.

The ultimate strategy to offer the best mobile banking app in the market is user-centric app design and development that efficiently meets user expectations.

For the best banking app development in the UK, contact Webskitters Ltd. Our team of experts is adept at delivering high-functional banking applications with a feature-packed, intuitive interface. We take pride in our years of expertise and proven track record in the banking and finance sector. Consult our team of experts to discuss banking app development costs.